Supply chains overview

Critical minerals

EV batteries

Q&A: What you need to know about clean energy and critical minerals supply chains

Hannah Chanatry

Author

Chloé Farand

Fanis Kollias

Data visualisation

Supply chains overview

- What you need to know about clean energy supply chains

- Can clean energy replace fossil fuels in the power sector?

- What are the key steps to manufacture clean energy technologies?

- How much does the clean energy supply chain need to grow to deliver on climate goals?

- Is manufacturing clean energy technologies more polluting than continuing to burn fossil fuels?

- Why are clean energy supply chains vulnerable?

- What does the move to “de-risk” global supply chains mean?

Supply chains overview

What you need to know about clean energy supply chains

Energy production – mainly the burning of coal, oil, and gas – is the largest source of climate-warming emissions.

Reducing those emissions requires a shift of our energy systems away from fossil fuels to renewable sources, such as solar and wind. At the Cop28 climate talks in Dubai in December 2023, countries agreed to triple renewable energy capacity by 2030 to decarbonise the power system and achieve net zero emissions by 2050.

This transformation requires a massive increase in the manufacturing and deployment of clean energy technologies, from solar panels and wind turbines to the batteries needed to store energy. The supply chains needed to produce clean energy technologies are a critical – yet sometimes overlooked – part of the energy transition.

Can clean energy replace fossil fuels in the power sector?

Yes. There is widespread scientific consensus that renewable energy and other clean sources, such as nuclear power, can and must dominate energy systems in the future to meet global climate goals. But there are different ways to get there.

The International Energy Agency (IEA) has set out a scenario aligned with reaching net zero emissions in the power sector and limiting warming to 1.5C. Under this scenario, renewable energy sources would meet two-thirds of global energy supply – including for transport, heating and industrial uses – and nearly 90% of electricity generation by 2050. Achieving this would require global energy use to fall by 8% through energy savings and behaviour change in wealthy countries, the use of coal to be virtually phased out, gas whose emissions are not captured to decline by 88%, and oil by 77%.

Alternative pathways to transform energy systems from fossil fuels to renewables make different assumptions, such as limiting the use of unproven technology and requiring greater reductions in energy demand. Some scientists argue that the world can reach 100% renewable energy systems by 2050.

Yet, these visions of the future remain a long way from the world we currently live in. Around 80% of global energy supply still comes from fossil fuels, which account for about three-quarters of global greenhouse gas emissions. At the same time, the growth of renewable energy sources, particularly solar and wind, is rapidly accelerating.

The IEA says global renewables capacity is on course to increase by two-and-a-half times by 2030 and governments have the tools to achieve the goal of tripling global capacity. In most parts of the world, renewable energy is the cheapest power option.

By early 2025, renewables are expected to become the largest source of electricity generation. Widespread electrification, including through the roll-out of electric vehicles and heat pumps, will help cut power sector emissions.

And yet, global energy demand has so far been growing faster than the adoption of clean energy sources. As a result, the world continues to produce more energy from fossil fuels and emissions from the power sector continue to grow, albeit at a slower pace. The IEA forecasts that demand for all fossil fuels will peak by 2030, but their use will need to fall dramatically to meet global climate goals.

What are the key steps to manufacture clean energy technologies?

Manufacturing clean energy technologies, such as solar panels, wind turbines and batteries, all begin in a similar way: by extracting and mining metals and minerals. Once out of the ground, these minerals need refining and processing – an energy-hungry process. Key components are then manufactured and assembled before being transported to where the technology will be installed.

Clean energy technologies will eventually reach the end of their lifespans (20-25 years for wind turbines and 25-30 years for solar panels) and need to be decommissioned. Without proper management, this is an environmental time-bomb. There are emerging efforts to recycle and reuse certain minerals and components of these technologies. Our Q&A on electric vehicles has more on emerging practices to recycle EV batteries.

How much does the clean energy supply chain need to grow to deliver on climate goals?

Every stage of the supply chain needs to expand for the world to decarbonise the global economy. Clean energy power systems require more minerals to build than their fossil fuel-based counterparts. The IEA estimates that achieving net zero emissions globally by 2050 requires a six-fold increase in the supply of critical minerals by 2040.

Manufacturing must rapidly scale up. If met in full, current plans to expand solar manufacturing capacity would be sufficient to meet solar panel demand by 2030 in a scenario that limits global warming to 1.5C. But there are considerable gaps in the manufacturing capacity for wind turbines, for example.

The IEA estimates an additional 12 million workers will be needed this decade to manufacture and install solar panels, wind turbines, heat pumps, and EVs. To triple global renewable energy capacity, energy storage capacity should increase sixfold by 2030, with batteries accounting for 90% of the increase. And electricity transmission lines need to expand by around 2 million kilometres every year this decade to meet needs in line with achieving net zero by 2050.

Is manufacturing clean energy technologies more polluting than continuing to burn fossil fuels?

Although there are significant emissions linked to the mining of minerals and manufacturing of clean energy technologies, the life-cycle emissions of solar panels, wind turbines and EV batteries remain far lower than those of fossil fuel-based technologies. Studies have shown that emissions from manufacturing solar panels and wind turbines are dwarfed by the emissions saved from avoiding burning fossil fuels.

However, clean energy supply chains remain an important source of pollution. In China, the manufacturing of polysilicon – the key component of solar panels – is powered by the availability of cheap coal. In Indonesia, coal plants are being built to power the energy-hungry processing of minerals for the battery industry.

And mining energy transition minerals is a dirty business, which if poorly managed risks increasing social harms and environmental degradation, such as deforestation, water depletion and pollution, and biodiversity loss. It is possible to mitigate and reduce those impacts including through regulation, community participation, resource efficiency such as reusing and recycling minerals, and energy demand reductions in some parts of the world.

Why are clean energy supply chains vulnerable?

Clean energy supply chains are highly concentrated in specific places, making them prone to geopolitical and trade disruptions.

Mining is the most concentrated stage, with a handful of countries responsible for nearly all critical mineral extraction. The Democratic Republic of Congo supplies 70% of the world’s cobalt, while Australia accounts for more than half of global lithium mining, and Indonesia 40% of nickel – all key components for EV batteries.

Across the supply chain, China has become a clean energy juggernaut. It supplies 60% of the world’s rare earth elements used to produce magnets for EVs and wind turbines, towers over the processing of critical minerals, dominates around 80% of all solar power production stages, and supplies 80% of battery cells worldwide.

This concentration leaves supply chains exposed to economic shocks and market volatility. Trade disruptions caused by the Covid-19 pandemic and Russia’s invasion of Ukraine, coupled with fears of a supply crunch for energy transition minerals, saw prices soar in recent years. However, in 2023 battery materials prices dropped following a glut in the market and a slowdown in EV demand.

At times, the supply chain is concentrated in places with poor labour and environmental regulations, leaving it open to human rights violations. In the DRC, cobalt mining has been linked to child labour and human rights abuses. Between one third and one half of the world’s solar-grade polysilicon used in solar panels is produced in China’s Xinjiang region, where the government is accused of subjecting members of the Uyghur ethnic group to forced labour.

What does the move to “de-risk” global supply chains mean?

The concentration of the clean energy supply chain in China has got western governments, including in the US and the EU, concerned. In response, they are investing in their own manufacturing capacity and in securing alternative supplies to reduce their reliance on Chinese imports. “De-risking” refers to this diversification drive.

This signals a shift away from earlier rhetoric of a full economic decoupling from China, which would have drastic global implications for the transition. Analysis from the energy consultancy firm Wood Mackenzie found that reaching net-zero by 2050 would cost 20% more – or about $6 trillion – without the supply of low-cost clean tech from China.

Critical minerals

- What you need to know about critical minerals

- What are critical minerals?

- What critical minerals does the world need to manufacture clean energy technologies?

- Is the world running out of critical minerals?

- Where are emerging frontiers for mining critical minerals?

- Can the world mine and process more critical minerals without exacerbating social and environmental harms?

Critical minerals

What you need to know about critical minerals

Critical minerals – among them lithium, cobalt and nickel – can be found in everyday technologies, like mobile phones and laptops. But they are also indispensable for manufacturing the clean energy technologies the world needs to decarbonise energy systems. From solar panels and wind turbines to batteries for electric vehicles and transmission lines, all need vast volumes of these minerals, causing demand to skyrocket.

Building an electric car, for example, uses around six times the mineral inputs of a conventional car, while an onshore wind plant requires nine times more mineral resources than a gas-fired one. Decarbonising the global economy will involve increasing mineral extraction and ensuring more sustainable mining practices.

What are critical minerals?

Critical minerals are minerals that are deemed essential for a country’s economy but whose supply is subject to major risks because of factors ranging from geopolitical tensions to basic availability. These factors differ from country to country, reflecting national priorities and changing global supplies. As such, there is no universal list of critical minerals.

The US has identified 18 materials as “critical” for clean energy because of the risk of disruptions to their supply chains. The UK’s own list of 18 critical minerals differs from that of the US while the European Union’s list runs to 34. However, there are notable overlaps when it comes to the materials the world needs for the energy transition.

What critical minerals does the world need to manufacture clean energy technologies?

Manufacturing clean energy technologies requires dozens of critical minerals. Several of them are needed across multiple technologies and are in particular high demand. These include:

- Lithium, a lightweight silvery metal, which is used in batteries for electric vehicles and energy storage.

- Cobalt, which is essential to power modern technologies. It has magnetic properties, is wear-resistant, and is used in lithium-ion batteries.

- Copper, a highly conductive metal, which is essential to electrical systems and is used in most clean energy technologies.

- Nickel, a hard metal that can also be bent or stretched easily. It is highly corrosion-resistant and is used to make stainless steel, which is used in wind turbines. It is also used in lithium-ion batteries.

- Rare earth elements, a subset of 17 critical minerals, which are essential to hundreds of modern digital technologies. They are used to make magnets for electric vehicles and wind turbines. Despite the name, rare earth elements are not geographically rare but they are difficult to extract and process.

Is the world running out of critical minerals?

While critical minerals are finite resources, there is no shortage of reserves. However, countries’ capabilities for mining and processing them are limited, and a supply crunch is looming. Global demand for critical minerals is exploding. The International Energy Agency (IEA) forecasts that reaching net-zero emissions globally by 2050 will require at least six times more critical mineral supplies by 2040 than today.

Yet, the pipeline of existing and planned mining projects isn’t enough to meet expected demand. At the start of 2023, the IEA foresaw a shortfall of 60% of the nickel and 35% of the lithium the world needs by 2030 to get on track to meet climate goals.

Timing and investment are key hurdles. New mines are not being built fast enough and the lead time from exploration to production can take more than a decade. A lack of proper consultation and poor practices can lead to opposition from local communities, causing delays.

Price volatility is another problem. After a rise in prices, the cost of battery minerals plummeted in 2023 amid a supply glut and a slowdown in EV demand, particularly in China. While this is pushing down the costs of making batteries, the price slump is leading to operations being reduced and projects being shelved.

Where are emerging frontiers for mining critical minerals?

Critical mineral production is concentrated in a handful of countries. But some nations hold vast untapped reserves. In South America, an area between Bolivia, Argentina and Chile, known as the “lithium triangle”, has nearly 60% of the world’s identified lithium reserves. Bolivia is home to the world’s largest known reserves, which until now have remained untapped.

Meanwhile, Africa holds 30% of the world’s critical mineral reserves, including rich deposits of cobalt, copper, manganese, lithium and platinum. But overall, the continent has received low investment in mining exploration. Several African countries are seeking to develop domestic production and processing of those resources, such as Zimbabwe.

Elsewhere, the race to secure minerals has fuelled interest in exploiting resources in the deep seas, on the moon and on asteroids in space. Deep sea mining proposals include vacuuming up mineral concretions on the sea bottom, which are rich in manganese, nickel, cobalt and rare earth metals – key components of batteries for electric vehicles. However, the idea is highly controversial because of the potential long-term harm to a largely unknown environment.

Can the world mine and process more critical minerals without exacerbating social and environmental harms?

The mining and processing of critical minerals pose both environmental and social risks. Conventional mining practices have caused pollution, deforestation and social conflict. Mining operations have infringed on the rights of Indigenous peoples, despite international protections. And scaling-up mining for the energy transition continues to pose such risks. A 2022 study, which reviewed more than 5,000 critical mineral mining projects, found more than half were located on or near Indigenous lands.

Calls for miners to adopt sustainable practices and not perpetuate the harms of past extractive industries are intensifying. Supply chains are facing increasing scrutiny from investors and consumers. This has led to industry-wide initiatives to address social and environmental abuses, such as the Solar Stewardship Initiative and the Global Battery Alliance. Transparency initiatives and due diligence frameworks have helped set standards. Meanwhile, the UN is analysing what responsible mineral development looks like and the justice and sustainability principles that should guide the industry.

In addition, technological developments can help reduce mining impacts. Lithium miners are working to reduce their water footprint while new extraction techniques touted as more environmentally friendly are being tested. Technological advances could help develop less mineral-intensive options to make batteries. Emerging sodium-ion battery technology could replace the need for lithium with more widely available sodium, for example.

Reducing energy demand, recycling and circular economy strategies could also help reduce the use of materials in the medium to long-term.

EV batteries

EV batteries

What you need to know about electric vehicles (EVs) and their batteries

What are EV batteries made of?

Who manufactures EVs and their batteries?

How fast are EV sales growing?

Is manufacturing EVs more polluting than continuing to drive combustion engine cars?

Can EV batteries be recycled?

What you need to know about electric vehicles (EVs) and their batteries

Batteries are an indispensable tool for the energy transition. They enable the electrification of vehicles and the decarbonisation of road transport, which accounts for more than 15% of global energy-related emissions. Boosted by advances in battery technologies, the sale of electric cars has seen exponential growth in recent years.

What are EV batteries made of?

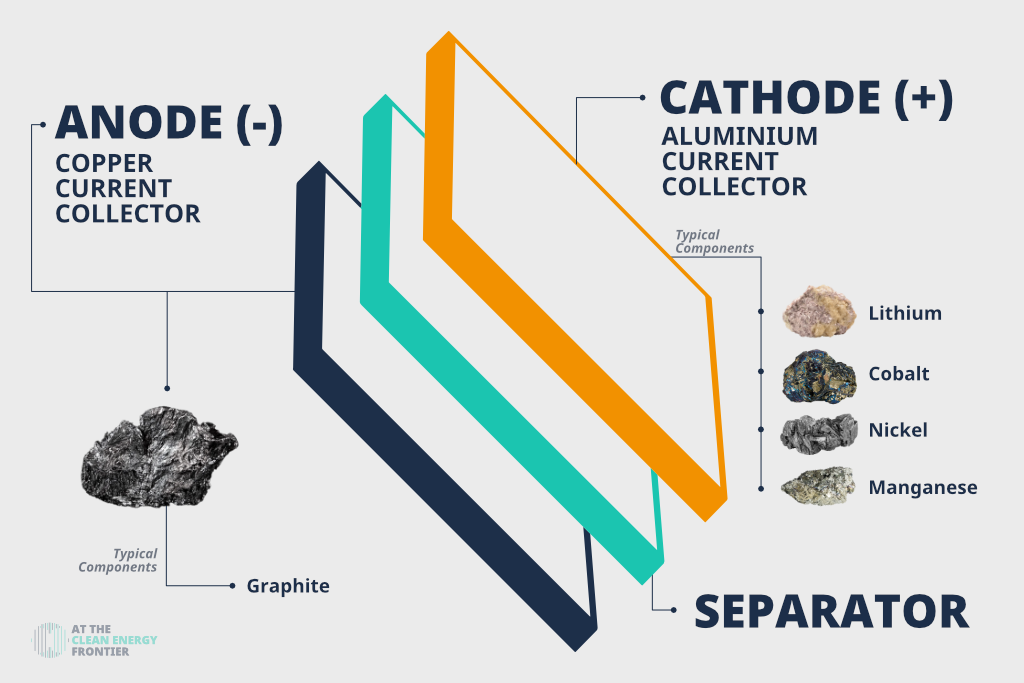

Today, most electric vehicle batteries are made with lithium. That’s because lithium batteries are small and lightweight and can pack the same amount of energy as other batteries. An EV battery pack is made up of thousands of rechargeable battery cells. Each cell is made up of a cathode and an anode – the “positive” and “negative” side of the battery. When the battery is being charged, the lithium ions move from the cathode to the anode through a separator. The flow reverses when energy is being discharged.

Source: Graphic inspired by Jessica Russo’s illustration for Natural Resources Defense Council

While the anode is usually made of graphite, the chemistry of the cathode can vary. The dominant type of lithium-ion battery technology, known as NMC batteries, requires nickel, manganese and cobalt. They have a long lifespan and high charge capacity. Lithium iron phosphate batteries, known as LFP batteries, do not require nickel or cobalt and use cheaper and more widely available iron and phosphate. They are less emissions-intensive to produce than NMC batteries but don’t hold as much energy.

Battery companies are also developing sodium-ion batteries, which replace lithium and other critical minerals with far more abundant sodium and other low-cost elements such as iron, nitrogen and carbon. These emerging batteries could help reduce pressure on mining critical battery metals.

Who manufactures EVs and their batteries?

China dominates the global EV supply chain. Chinese carmakers produced more than half of all electric cars sold worldwide in 2023.

The country produces roughly three-quarters of all lithium-ion batteries, controls most of the production capacity for cathodes and anodes, and is home to more than half of the global refining capacity for lithium, cobalt, and graphite used in battery technologies.

Two Chinese battery makers stand out: CATL, the world’s largest battery manufacturer, and BYD, which overtook Tesla as the world’s best-selling EV maker at the end of 2023.

However, a number of countries have set out to compete with China. The US, Canada and Europe are among nations strengthening their battery manufacturing capacities.

How fast are EV sales growing?

EV sales have grown exponentially. The falling price of lithium-ion batteries – the most expensive component of an EV – has contributed to rising demand. In the last 30 years, the price of batteries plummeted by 97%. As a result, EV sales soared, jumping from around 1 million in 2017 to more than 10 million in 2022. Research provider BloombergNEF predicts that EV sales will reach 16.7 million in 2024, accounting for more than one in five cars sold worldwide.

Despite current high inflation and volatile battery metal prices, the IEA anticipates that under today’s policies, one in two cars sold globally is set to be electric by 2035. That could increase to two in three cars if countries meet their energy and climate pledges on time. As a result, EVs are expected to use between 6-8% of the world’s electricity by 2035, up from the current 0.5%.

To meet global climate goals, EVs will need to make up 60% of global car sales by the end of this decade – up from about 18% in 2023.

Is manufacturing EVs more polluting than continuing to drive combustion engine cars?

No. The life-cycle emissions of EVs are significantly lower than those of combustion engine cars, and the gap increases as the electricity mix decarbonises.

It’s true that manufacturing EVs is more polluting than producing their gasoline and diesel counterparts, largely because of the emissions linked to manufacturing the battery. But the difference quickly disappears as the car is driven. Studies show that EVs pay back emissions from battery production after about 2 years. The more miles the car is driven, the bigger the EV’s emissions savings become. A Carbon Brief analysis shows that even if a new EV replaces an existing conventional car in the UK, it would still start to cut the driver’s emissions after less than four years.

The International Council on Clean Transportation found that the lifetime emissions of medium-size EVs are about three times lower than comparable combustion-engine cars in the US and Europe. In China and India, where coal still generates most of the electricity, EVs’ lifetime emissions were respectively 40% and 25% lower. The study found that EVs entirely powered by renewable energy had emissions 81% lower than gasoline cars.

On average, the IEA estimates that an electric car sold in 2023 will emit about half as much climate-warming emissions as combustion engine equivalents over its lifetime.

Can EV batteries be recycled?

Yes. EV batteries can be recycled, though the process is difficult and in its early stages. An anticipated surge in the number of EV batteries reaching the end of their use around 2030 has accelerated efforts to increase global recycling capacities.

Most EV lithium-ion batteries have a lifespan of roughly 15 to 20 years. After that, batteries may no longer be suitable to power vehicles but could have a second life storing excess power generated by renewable energy. When the battery reaches the end of its life, the minerals inside it can still be reused through recycling.

However, EV battery packs are not standardised and are rarely designed with recycling in mind, making recycling efforts difficult and expensive. In addition, lithium-ion battery chemicals become highly volatile at the end of their lifetime and can turn into fire hazards, or leak into the environment if improperly disposed of, causing pollution. It’s also technically difficult to recover minerals and can be a dirty process. Dominant battery recycling methods either burn away most of the battery, leaving few minerals to recover, or use a highly chemical process to recover minerals.

More efficient recycling methods, such as direct recycling which keeps the cathode intact in the process, are emerging, with car manufacturers such as BYD and BMW also investing in recycling.

The IEA estimates that recycling copper, lithium, nickel and cobalt from used batteries could reduce their combined mining requirement by around 10% by 2040.