India

Indian start-ups mine e-waste for battery minerals but growing industry has a dark side

Cheena Kapoor

Author & Photographer

India

Indian start-ups mine e-waste for battery minerals but growing industry has a dark side

Recycling e-waste can unlock a vast and sustainable supply of transition minerals but in India the sector relies on a neglected informal economy

Cheena Kapoor

Author & Photos

By 4am, Abrar, aged 50, reaches Seelampur, a small neighbourhood in the capital’s north-east suburbs, which is home to India’s largest electrical-waste market.

The market’s narrow lanes are lined with small scrapstores overflowing with piles of broken computers, telephones, TVs, microwaves, washing machines, ACs and end-of-life batteries.

Abrar is one of more than 50,000 informal workers, including women and children, who make a living sifting through thrown-out goods to recover valuable materials that can be recycled and eventually reused in modern technologies.

In recent years, Abrar and his peers have become the backbone of a fast-growing network of start-ups seeking to extract energy transition minerals from e-waste in a process known as “urban mining”.

Seelampur’s e-waste market is a vast treasure trove for the highly-coveted metals and minerals the world needs to shift from fossil fuels to clean energy systems and curb climate change.

Charging cables for everyday items contain copper, a conductive metal which is used in virtually all electricity-related technologies. The aluminium in electronic components is needed to manufacture solar panels.

But most sought after still are batteries. The majority of electronics such as mobile phones, laptops and vapes use batteries that contain lithium, cobalt and nickel. The same minerals are used to make batteries for electric vehicles (EVs) and storing renewable energy.

‘Toxic sink’

Day after day, Abrar fills up his cart with e-waste and transports it to traders, who sell on valuable parts and metals to recycling companies keen to get a share of this largely untapped supply of transition minerals.

Handling the hazardous waste is gruelling and dangerous work for little pay.

Workers in the market open up worn batteries and electrical devices using stones and hammers. Heat is used to extract iron, aluminium and gold, releasing toxic fumes that engulf the market, giving it its nickname of “toxic sink”.

Like most workers, Abrar does not own any basic protective gear such as gloves and a mask. But the work is a lifeline. “I must do this for my family. The more waste I deliver, the more I earn,” he told Climate Home News.

From e-waste to batteries

Among the companies seeking to capitalise on e-waste as a vast secondary supply of transition minerals is Metastable Materials.

The Bengaluru-based start-up, which is backed by some of India’s biggest venture capital firms, sources lithium-ion batteries from disused electronics at Seelampur’s market to recover minerals including lithium and cobalt that can be used again to make new batteries.

The start-up is part of a nascent industry of small companies seeing e-waste as a ready battery recycling stock. Projections estimate India’s e-waste recycling market to reach $7.5 billion by 2030. And India’s small battery recycling industry is anticipated to grow tenfold to $1 billion by 2030, according to financial services firm Avendus.

“We are working towards creating a circular economy for critical minerals,” Shubham Vishvakarma, Metastable’s co-founder, told Climate Home during an interview at a co-working office in Bengaluru, the heart of India’s tech industry.

Recycling could supply a significant share of the huge amounts of minerals the world needs for manufacturing clean energy technologies without the social and environmental impacts associated with mining.

The International Energy Agency estimates that recycling could reduce the growth in new mining needs by 40% for copper and cobalt and by 25% for lithium and nickel by 2050. In addition, recycled transition minerals incur on average 80% less greenhouse gas emissions than minerals extracted from mining.

“Extracting minerals from traditional mines is very expensive and harms the environment,” Pratibha Sharma, an Indian project analyst working on the circular economy for the UN Development Programme, told Climate Home. “Urban or secondary mining is a great opportunity to improve the circular economy and accelerate the energy transition,” she said.

Metastable has devised a process to recycle end-of-life lithium-ion batteries, which it says is cheaper and cleaner than dominant technologies because it doesn’t use chemicals and is less energy-intensive.

Operating out of a small warehouse on the outskirts of the south Indian city, the start-up says it is “committed to providing environmentally friendly metal extraction technologies for lithium-ion batteries” and to helping “accelerate EV adoption”.

But so far, the company is reliant on informal workers like Abrar to source disused batteries for recycling.

Hidden workers

Despite handling hazardous waste of great value to the recycling industry, Abrar earns merely $6-7 a day – below the government-set minimum wage of $8 per day for an unskilled worker in Delhi – and receives no social protection.

Javed, 25, has been working at the market since he was 15 years-old. Every two to three months, he sends money home to his family in the nearby state of Uttar Pradesh but his earnings are not enough for him to change his fortunes.

But new players in the recycling space should regularise informal workers in the supply chain and provide them with a share of the proceeds, Singh argued.

Recycling companies have previously sourced worn-out goods from e-waste markets in India. But none of them have provided workers sufficient social guarantees, such as a decent wage and health insurance, he added.

Javed sits on large bags of e-waste in the Seelampur market

But regularising the decade-old waste-picking and sorting sector is a huge task – one which the Indian government has so far failed to achieve, let alone a small start-up seeking to scale, company boss Vishvakarma argued.

“The whole EV industry is trying to ensure that the supply chain for batteries remains formal from the beginning, but it’s proving to be a difficult job,” he told Climate Home.

The Indian government didn’t respond to requests for comment.

Urban mining opportunity

Yet, for India, urban mining offers a vast opportunity to shore up supplies of pivotal minerals for its surging electric scooters, bikes and three-wheeler vehicle market.

The world’s most populous country, which is building out its own battery manufacturing industry, is 100% dependent on imports for battery minerals such as lithium, cobalt and nickel, including from China, the world’s largest processor of transition minerals.

To secure domestic supplies, the government is seeking to expand the country’s recycling capacities. The government has set targets for 90% of EV battery materials to be recovered by 2027 and for new batteries to use at least 20% of recycled materials by 2030.

It recently announced plans for a Critical Minerals Mission with a focus on recycling and is supporting research and innovation in the mineral recycling sector. The Ministry of Mines is reportedly developing a scheme that would financially reward companies investing in urban mining and recycling of e-waste.

Electronic scrap, including discarded electric wires, is weighed for selling to traders

A toxic timebomb

Global efforts to scale the recycling industry cannot come soon enough.

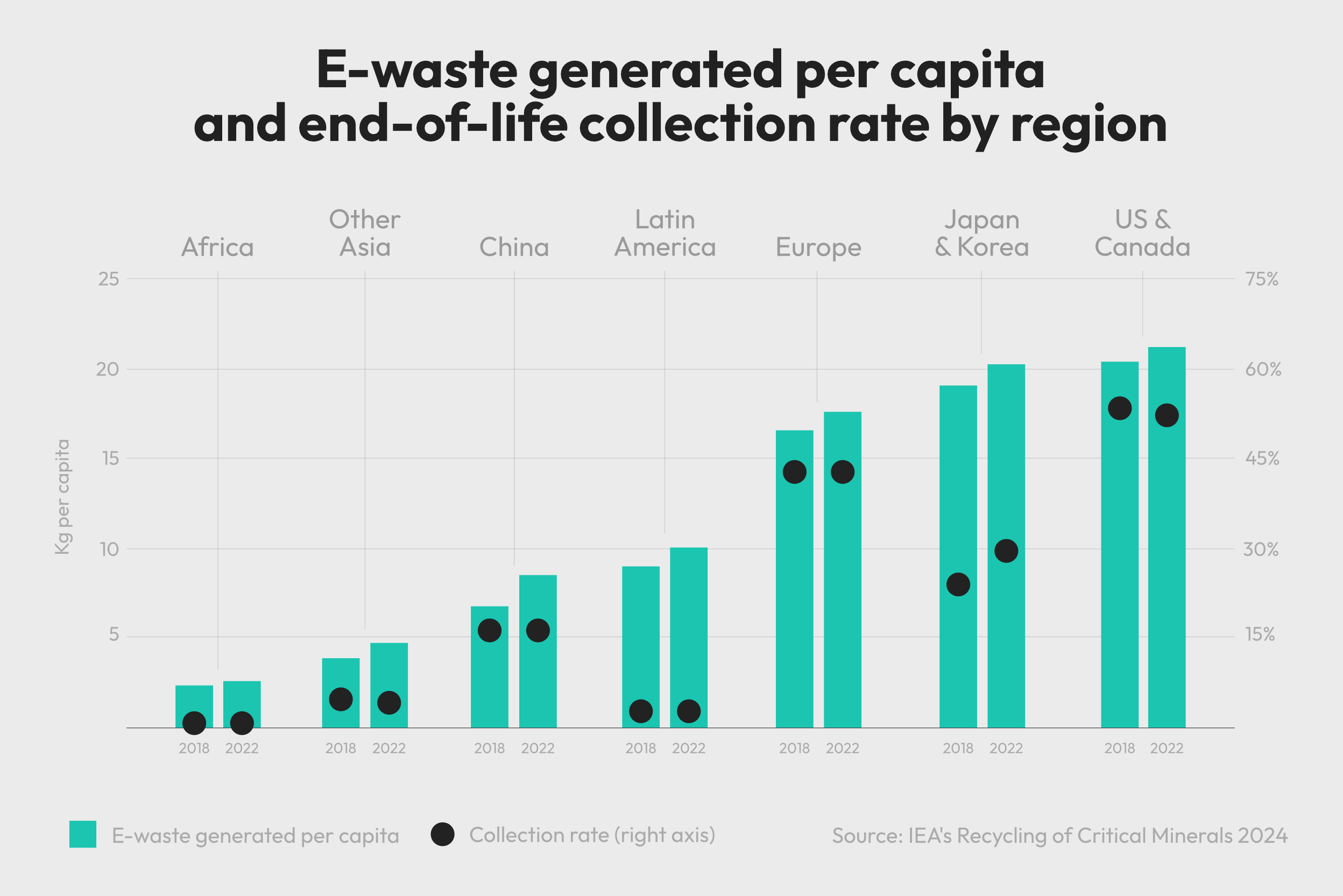

The world is generating a record amount of electronic waste. In 2022, 62 million tonnes of e-waste found its way to landfill, according to the UN. If put in bumper-to-bumper 40-tonne trucks, this e-waste could encircle the equator. But only around a fifth of e-waste was reported to be formally collected and recycled.

Like the rest of the world, India’s e-waste problem is set to soar if recycling infrastructure and policies are not put in place rapidly, driven largely by the rise in clean energy technologies such as solar panels and batteries.

Analysis by Niti Aayog, a government policy think-tank, estimates new batteries would create a recycling volume of 128 gigawatt hours by 2030, of which nearly half will come from EVs. To meet this recycling need, India’s lithium battery recycling capacity would need to increase about 60 times between 2023 and the end of the decade.

Turning waste into ores

Founded by two Indian Institute of Technology Roorkee graduates in 2021, Metastable is on a mission to turn battery waste back into ores.

Recycling lithium-ion batteries is not an easy task. Dominant battery recycling methods either burn away most of the battery in an energy-intensive process which leaves few minerals to recover, or use a highly chemical process – a costlier method, which generates chemical waste.

Instead, Metastable’s patented process uses machines to crush batteries into black mass, which is then heated at high temperatures just short of 900C – yet lower than traditional heat processes which can require temperatures upwards of 1,400C.

The process uses the metals’ physical properties such as magnetism, water solubility, size and density to separate the minerals from each other, explained Manikumar Uppala, Metastable’s co-founder and chief of industrial engineering.

To achieve this, the company has designed bespoke tools and machinery. This includes three sets of scrubbers – equipment designed to catch pollutants in gas – “to ensure no harmful gas is released in the environment”, Uppala explained.

The final products include copper, aluminium, cobalt-nickel alloy and lithium carbonate that match the quality of those traded on international markets, where they are sold for a range of uses, including EV batteries.

Steel casings, plastic and even the lithium fluoride, a by-product of the recycling process which has applications in the optical and pharmaceutical industries, are recovered and sold to commodity traders – leaving practically no waste.

Metastable says the process uses three litres of water per kilogramme of recycled waste – far less than existing technologies that can use anywhere between 10 and 100 litres. By recycling battery metals to a state that can be used for multiple applications, the company says it is able to cut costs.

This process will “disrupt the battery value chain by providing cost-competitive low-carbon minerals to the industry,” Vishvakarma told Climate Home.

“Recycled minerals serve to reduce the dependance on virgin mining, bring down associated greenhouse gas emissions, bolster the bottle-necked supply chain and solve serious social and environmental issues,” he added.

In the next five years, the start-up aims to have capacity to recycle around 5% of India’s disused lithium-ion battery volume, including end-of-life EV batteries.

The right to decent work

As India sets out to massively expand its recycling capacity, international calls to formalise work in e-waste markets are growing.

Last year, a UN panel appointed by Secretary-General António Guterres called for justice and equity to underpin transition minerals supply chains, including at the recycling stage.

“Decent work, which includes adequate universal social protection, opportunities for skills development, rights at work, job creation, and social dialogue, is essential for any just transition,” the panel concluded.

UNDP is working with the Indian government on a $120 million project to improve the country’s e-waste management and formalise the work of people like Abrar. The Seelampur e-waste market is among the project’s pilots.

One way to achieve this is to make companies responsible for their products along their entire lifecycle, including their disposal and recycling, which is known as Extended Producer Responsibility (EPR), Sharma explained.

In 2022, the Indian government introduced mandatory EPR guidelines for all companies in the lithium-ion battery ecosystem.

The initiative compels battery manufacturers to collect end-of-life batteries, deliver them to certified recyclers and invest in recycling operations. But it won’t transform the market overnight.

In the meantime, for thousands of informal workers like Abrar, who survive on the meagre income they receive sorting the waste that could power the energy transition, there are few signs of a better living.

Despite his failing health, Abrar drags his handcart brimming with toxic waste every day. “Nothing will change here, life will go on like this,” he said.

Main image: A man breaks down circuit boards to separate metals like copper from plastic

Cheena Kapoor

Author & Photos

Chloé Farand